(Previous Topic: Log Data/Tips Tab Options)

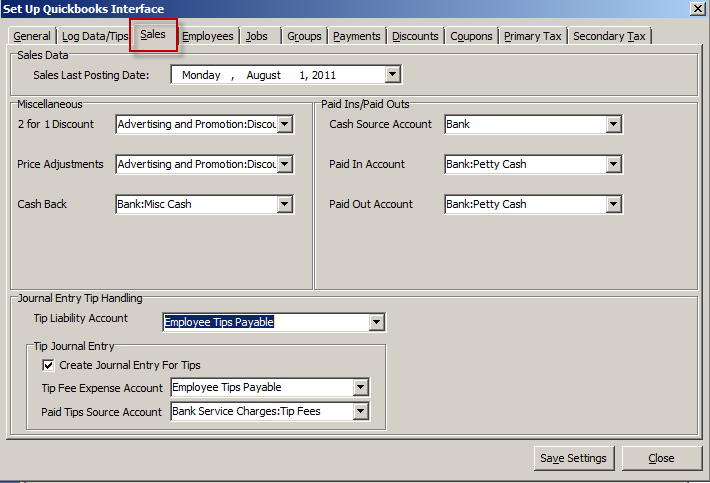

Sales Tab Options

The Sales tab provides for setting up of the sales data related options. If you are going to be using the interface in sending Restaurant Manager sales data to QuickBooks, the Groups, Payments, Discounts, Coupons, Primary Tax and Secondary Tax tabs need to be set-up too. The following list outlines the functionality of each setting under this tab:

Sales Last Posting Date - To be set-up to tell the interface (POSQBi) the last sales date that was successfully sent to QuickBooks. This is used as the basis when retrieving Restaurant Manager (RMPOS) sales data and in providing a warning to the user in case there is a possibility of double posting.

Miscellaneous Sales Settings -The following options under the “Miscellaneous” group should also be assigned with the proper accounts when being sent to QuickBooks as a General Journal entry:

- 2 for 1 Discount – the account to use when sending to QuickBooks for recording expenses incurred for sales that are 2 for 1 discounted. Normally, this QuickBooks account type would be an Expense or Other Expense.

- Price Adjustment – the account to use when sending to QuickBooks for recording price adjustments. It is assumed that price adjustments would be done as a fixed amount discounting, if so, the entry would be a debit line to an Expense or Other Expense account. However, if the price adjustment increases the sale amount, then a credit line to the same account.

- Cash Back – the account determined to be the fund source when giving cash back specially for transactions paid by a debit card. Normally, the QuickBooks account type would be Bank or r a sub account of “Bank”.

Paid Ins/Outs Options- The following options under the “Paid Ins/Out ” group should also be assigned with the proper accounts when being sent to QuickBooks as a General Journal entry:

- Cash Source Account-Use the drop down menu to map the cash source account in QuickBooks used for Paid In/Out

- Paid In Account- Use the drop down menu to map the cash source account in QuickBooks used for Paid Ins. This may be a "other income" account or sub account of the cash source.

- Paid Out Account- Use the drop down menu to map the cash source account in QuickBooks used for Paid Outs. This may be a "other expense" account or sub account of the cash source.

Journal Entry Tip Handling Options- The interface (POSQBi) could be set-up to create a paid tip journal entry in QuickBooks. Paid tips refer to the amount paid to the employee at the end of the shift including tips from credit card, check or charge sales.

- Tip Liability Account – the assigned account that corresponds to the QuickBooks account being set-up to handle paid tips. Before the tip is actually given to the employee, it is being treated as a liability of the restaurant to the employee.

- Create Journal Entry For Tips - if checked, the interface (POSQBi) to create journal entry lines for tips received from the customer and paid to the employee.

If the restaurant does receive tips and pay them to the employee (i.e. in fine dining places), it is highly recommended that this be checked. If not (i.e. in fast food places) where tips are not the norm and then leave this unchecked.

If you have this option checked, accounts must be assigned to the following items:

Paid Tips Source Account – the assigned account that corresponds to the where the amount of the tip paid to the employee is actually to be taken out from. Usually, the account to be assigned is of Asset/Bank type.

Tip Fee Expense Account – the assigned account that corresponds to the account is used by the restaurant in recording tip fee expenses/charges. In the interface (POSQBi), this will be entered as a negative debit.

The account drop down menu function by default displays all account available in QuickBooks. However, this function can be configured to display certain account types by right clicking on the field and choosing a specific account type (i.e. bank or expense). This is convenient when configuring multiple data fields within the same programming session (typically occurs with initial installation)

Note: Refer to the Restaurant Manager User Manual regarding the 2 for 1 Discounts and Price Adjustments feature of the Restaurant Manager (RMPOS). Also, refer to the QuickBooks manual in setting up accounts.